Hedge funds are a new economic entity that is making fortunes and creating despair left and right. An incredibly complex business, hedge fund investing is truly a gambling man’s game.

The balance of risky and safe investments, personal convictions, and an eye for effective office design and staffing are just a few of the crucial factors to managing a hedge fund that will produce growth for your clients.

We’ve taken a look at three factors that could boost your chance for successfully managing a hedge fund. While this is by no means an exhaustive guide, we believe it’s a great starting point if you’re considering launching your own fund.

Risk and Safety

Every hedge fund wants to promise insane amounts of growth for their clients. Unfortunately, with ever-changing markets, you need balance.

While taking advantage of the markets is truly a gamble, the real skill in managing a hedge fund is mitigating the inevitable possibility of loss while keying into to crucial value-generating assets. Often times those who have “lost it all” got ahead of themselves either pushing too hard on risky investments, or losing out on desperately-needed growth opportunities from a fear of loss.

The mitigation of risk is a tricky game at best. While using historical data is crucial to developing a reasonable estimation of a particular asset’s performance, it’s also important to use some of your capital to play it safe. Investing in safe financial instruments like bonds will allow your fund to grow consistently and prepare your firm to weather big-time losses from riskier financial assets.

In all, it depends on both how confident you are and how you want the fund to present itself to potential clients. Some investors are drawn to more risky investment strategies, either because they have a lot of spare capital or they truly enjoy the thrill of potentially hitting it big on something new.

Your strategy for balancing safety and risk will ultimately be entirely your own. Investment strategies are entirely proprietary as well—that means studying the approaches of other hedge funds should only be a part of developing your own particular success plan.

Conviction

As we enter a world more conscious of global warming, societal issues, and a political environment that is uncertain at best, personal convictions are a growing part of the investment world. Many wealthy people use their money to support what they believe in, which means expressing your convictions through your investment strategy might be a way to attract potential investors.

For instance, environmental issues are increasingly moving to the forefront. Alternative energy development is taking place at all levels of the energy sector, and some investors want to support that change with their dollars. Other investors are passionate about particular industries.

People who have disposable income to invest often see their money as a way of making an impact on the world around them. Some hedge funds are also moving in this direction, in part to attract potential clients.

The importance of conviction is in how you monitor what is important to you. If you are an alternative energy hedge fund, keeping abreast of industry developments is crucial. You’ll also want to market your hedge fund accordingly, meaning if you are investing in a cause your conviction could be what brings your next investor through the door.

Staffing and Office Design

While staffing is an obvious consideration, office design is something a bit more unclear. We’ll tackle the former first.

Staffing is important because, in as high-stakes of an industry as hedge fund management, you want to find the best people you can possibly afford. That’s because in the end, the fund’s reputation is on the line if mistakes are made.

Simply put, you want to be able to blame losses on things beyond your control. This is because investor confidence is everything in keeping the money flowing in, and staying there. Hiring novice traders, or not having a properly-equipped legal team will certainly gouge investor confidence, in some cases permanently.

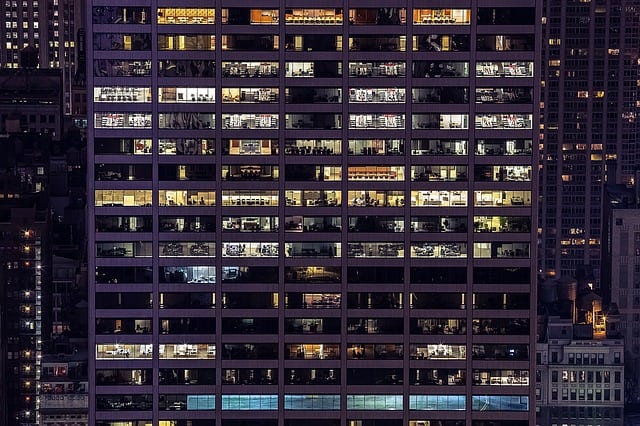

Office design is important for a couple different reasons. First, having an attractive office can help solidify investor confidence. Many high-value investors are quite well-acquainted with more attractive settings—the decisions of high-value investors can make or break your business, so having an attractive meeting space is another way to instill confidence in these clients.

Communication is also key when managing a hedge fund. Intuitively-designed offices will foster effective communication among all departments, and something as simple as office design can have a major impact on business operations.

Wrapping It All Up

As stated above, hedge fund management is a tricky and complex business. That’s why this guide should not be considered a complete guide for success.

But, these above factors all play a part in running a successful hedge fund, some more clearly in your power, and others not so much. Understanding what is in your control is one of the most important factors of success regardless of industry. The next most important factor is the motivation to act on what you control.